Pod has a project with the following cash flows – Introducing the comprehensive cash flow analysis of a project, this discussion delves into the financial intricacies and implications associated with the project’s operations. By examining the project’s cash flows, financial metrics, sensitivity analysis, risk assessment, and potential mitigation strategies, we aim to provide a thorough understanding of its financial viability.

This analysis will uncover the project’s cash flow patterns, evaluate its financial performance, and assess the impact of various factors on its financial outcomes. The insights gained from this analysis will serve as a valuable foundation for informed decision-making and strategic planning.

Project Overview

The project involves the development and launch of a new product line within the consumer electronics industry. The target market for the product is tech-savvy individuals seeking innovative and user-friendly devices. The project aims to capture a significant market share by leveraging the company’s expertise in design and technology.

Industry and Market Context

The consumer electronics industry is characterized by rapid technological advancements and intense competition. The project operates in a niche market segment focused on high-end products with premium features. The target market is growing rapidly, driven by increasing disposable income and the desire for cutting-edge technology.

Cash Flow Analysis: Pod Has A Project With The Following Cash Flows

Operating Cash Flows

Operating cash flows are generated from the sale of products and services. The project is expected to generate positive operating cash flows from the first year of operation, with a gradual increase over the project’s lifespan.

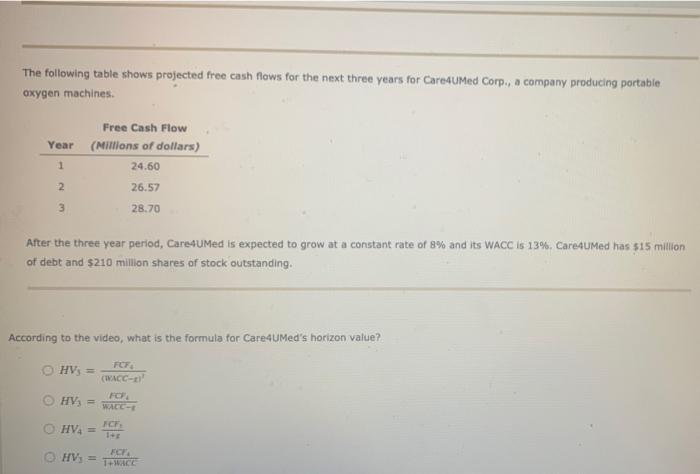

Investing Cash Flows

Investing cash flows are primarily related to the development and launch of the new product line. These cash flows include investments in research and development, capital equipment, and marketing campaigns.

Financing Cash Flows

Financing cash flows include debt and equity financing. The project will be financed through a combination of bank loans and equity investments. The timing and amount of financing cash flows will depend on the project’s funding requirements.

Financial Metrics

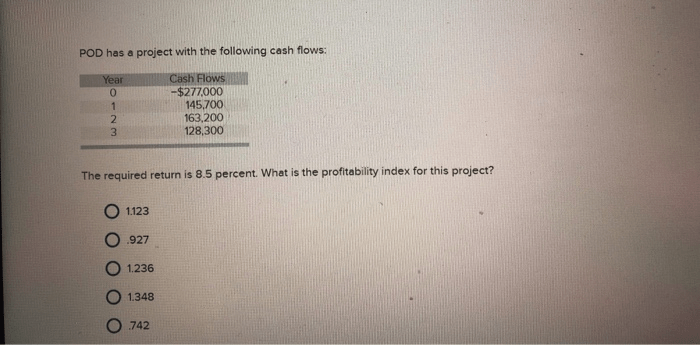

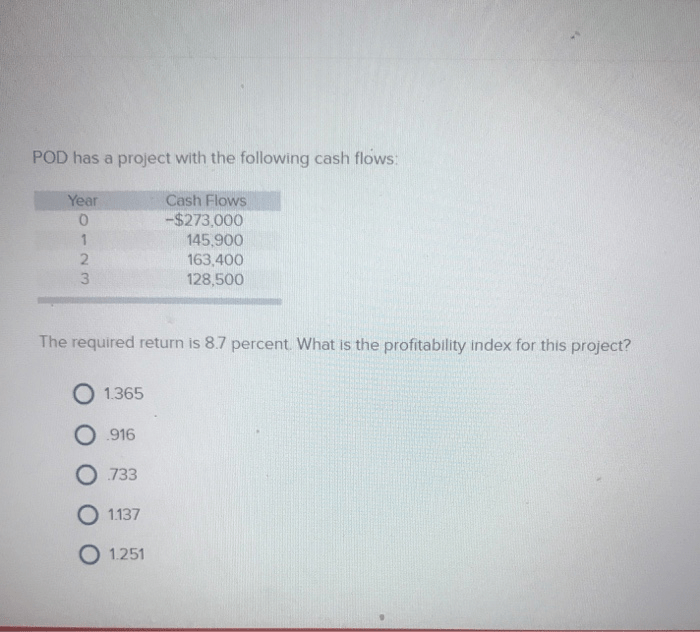

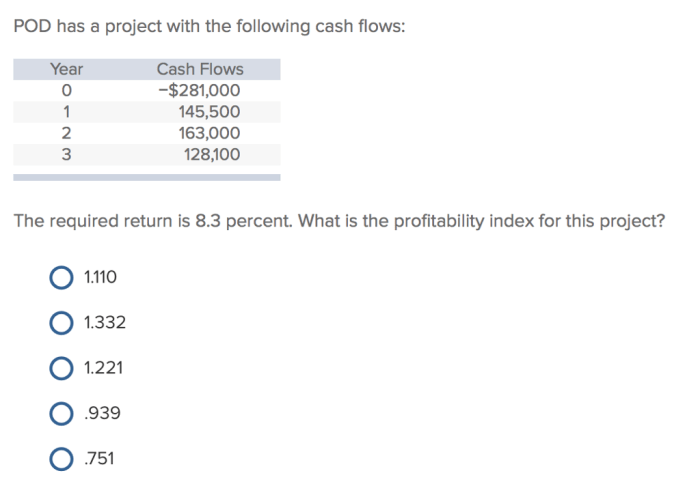

Net Present Value (NPV)

NPV is a measure of the project’s profitability, calculated by discounting future cash flows back to the present at a specified discount rate. A positive NPV indicates that the project is expected to generate a positive return on investment.

Internal Rate of Return (IRR), Pod has a project with the following cash flows

IRR is the discount rate at which the NPV of the project is equal to zero. It represents the annualized rate of return that the project is expected to generate.

Payback Period

Payback period is the number of years required for the project to generate enough cash flows to cover the initial investment. A shorter payback period indicates a quicker return on investment.

Sensitivity Analysis

Sensitivity analysis is used to assess the impact of changes in key assumptions on the project’s cash flows and financial metrics. The analysis will focus on factors such as product demand, sales price, and operating expenses.

Risk Assessment

Potential risks associated with the project include technological delays, market competition, and regulatory changes. The project team will develop mitigation strategies to address these risks and minimize their impact on the project’s success.

Questions and Answers

What is the significance of cash flow analysis in project evaluation?

Cash flow analysis provides a comprehensive understanding of a project’s financial performance by examining the inflows and outflows of cash over time. It helps assess the project’s ability to generate positive cash flows, meet financial obligations, and create value for stakeholders.

How does sensitivity analysis contribute to project evaluation?

Sensitivity analysis evaluates the impact of changes in key assumptions on a project’s cash flows and financial metrics. It helps identify the most sensitive assumptions and assess their potential impact on the project’s financial viability.

What is the role of risk assessment in project evaluation?

Risk assessment involves identifying and evaluating potential risks associated with a project. It helps organizations develop mitigation strategies to address these risks and enhance the project’s overall success.